Energy Rebates and Tax Incentive Programs

The Federal Government, some states and utilities, and quasi public institutions offer rebates and tax incentives to commercial and industrial facilities for energy-efficient upgrades. Cash rebates will lower your costs when purchasing high efficiency building equipment such as burners, boilers, and other building-wide equipment.

Rebate programs are most common for energy intensive appliances such as refrigerators, air conditioning equipment, and clothes washers. However, utilities and quasi state agencies also offer cash rebates for large items including rebates for high-efficiency furnaces, sump pumps and water pumps while water utilities may offer rebates for water-saving clothes washers.

A number of states have introduced tax incentives, typically income tax credits or elimination of state sales tax for the purchase of high-efficiency appliances (lighting, etc).

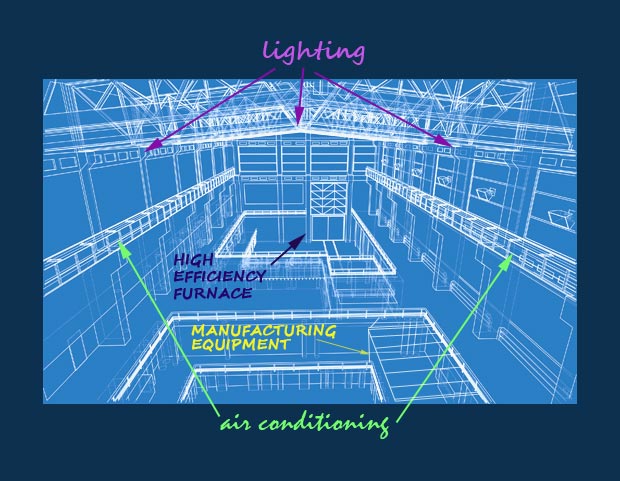

Design and Implementation of Energy Efficiency Plans

MEMO will design, and implement a plan to make your building more energy efficient and MEMO will file all the necessary paperwork to ensure your tax credit, grant, or cash rebate is processed correctly. MEMO will work with any state agency energy programs or any utility company's energy efficiency programs to make sure to mazimize your savings. We are partners with NYSERDA and NJCEP.

We've done projects with Connecticut Light & Power, Con Edison, and LIPA.

For more information you may go to the sites above but we suggest you contact us for faster savings and so we can help you find the best rebates and incentives for your facility.

View our Solar Rebates page for more information about solar power cost savings.

MAXIMIZE YOUR ENERGY SAVINGS

We'll find the best rebates, tax incentives and savings opportunities for your commercial business

CONTACT US NOW TO LEARN ABOUT REBATES AND INCENTIVES FOR YOUR BUSINESS

Contact Us

Get information about energy improvement rebates and incentives for your business or buildings.

Connect With Us

Interact with us on social media to get energy rebate information